Did you know that superannuation regulations have changed quite a bit in the last few years? This article focuses on some of the superannuation changes that may be relevant to you.

Understanding the Bring-forward rule under the Total Super balance caps

Generally, an individual can bring forward 2 additional years of non-concessional contribution, in the year they choose to make a non-concessional contribution. To understand this better, let us step back to understand what a non-concessional contribution is.

Superannuation contributions

There are 2 main categories an individual can contribute into super; concessional (pre-tax) and non-concessional (post-tax) contributions. The pre-tax contributions are capped at $25,000 per financial year and the post-tax contributions are capped at $100,000 per financial year. An individual can choose to contribute 2 extra years ($200,000) in addition to the year in which they are making a non-concessional contribution, making it $300,000 in total. This is known as the bring-forward.

What has changed: –

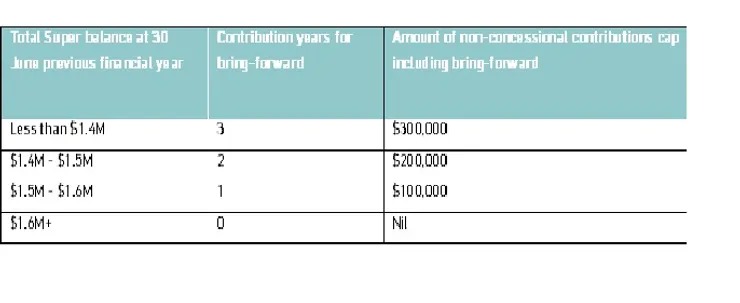

On 1 July 2017, total superannuation balance was introduced. This is the balance of your super fund at the end of June 30 of the previous financial year. Once your total super balance exceeds $1.4M, you lose the ability to take advantage of the full bring forward of the non-concessional contributions.

Understanding the impact of the total super balance and the bring-forward rule.

So what?

Superannuation is the most tax-efficient vehicle for your retirement income. Any income received from super after age 60, is tax-free. Any income earned within super after age 60, could be tax-free. Early and careful planning is key, especially if you are close to age 65 and you have a super balance of more than $1.2M. It is not as simple as contributing the maximum you can. But it takes strategically planning out how to contribute funds into super to ensure you can maximise your tax-free income when you retire.

General Advice Warning:

This article is prepared without taking your personal circumstances into consideration. It is very general in nature and before you implement anything based on the issues discussed here, we’d recommend you speak to us first to understand how these changes affect you.